Developing a Budget During RetirementUntil I recently retired I had never worked to a strict budget and although I was well paid I was often caught short of money.

Do What You Can"Do what you can, where you are, with what you have." It always makes me stop and think about what I want to do and if I can accomplish it without having to buy anything for the project.

Create a Budget and Cut ExpensesIt took me 7 years to pay off my student loan and I had only a small loan. When paying off your student loans, you need to create a budget where you allocate for making that payment every month.

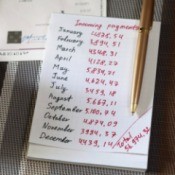

Keeping a Spreadsheet to Monitor BudgetI use a spreadsheet I made up to list all expenses and income right down to the penny. The spreadsheet lists income, and then all expenses such as groceries, gas, each utility, eating out, prescriptions, credit card bills, miscellaneous expenses, absolutely everything.

Remember Your Membership DiscountsUse your Costco or AAA memberships for discounts on movie tickets. Both offer discounts to members. Check your benefits packages, and you may find that cheap tickets are a perk to having a membership!

Keeping Track of Receipts for TaxesI use a monthly calendar to organize my financial life. I don't use a fancy one, just one that I receive as a promotional free item. I staple all check stubs and I write the amount of my receipts on the day that I had the expense.

Spending ListsWhen it comes to our finances, they're very abstract. Check cards and electronic bill paying don't make it much easier; the concept of exactly how much money is spent is a difficult one to grasp.

Check Register Tip - Round UpWhen I enter an amount taken from my checking account either by check or debit card I always enter the correct amount in the ledger but I round up the amount I deduct from the checking account.

Budget Something For FunNo matter how broke you are or how frugal you are being, there should always be something in the budget for entertainment. We all need that to re-charge.

Look at the Dollar a DayFace it, budgeting is hard. Sometimes what makes it so difficult is the "big picture." Paying $50 a month for something doesn't seem so bad until you realize how many things cost $50 a month. Now the $50 turned itself into $250 a month.

Create Your Ideal BudgetStart by listing everything that you spend money on each month and how much you spend. Add up the list to get your current total budget. Once you have that information you can start creating your ideal budget.

Discretionary Vs. Mandatory SpendingWhen making a budget, be sure to identify Discretionary and Mandatory expenses.

Making a Money MapAt the end of the month, you'll have a money map. You'll know how much you're spending, and on what. And then you'll be able to make some changes (and perhaps even spare your "special Coffee Drinks").

Staying on the BudgetIn an effort to stay as much on a budget as possible and track my spending I have finally found an easier way. I keep my check book in my purse and use is to record my deposits and withdrawals, of course, but I also keep a small ledger in my purse.

Year End Budget AnalysisEven if you didn't save all your receipts from last year, you still can analyze your expenses and use that information to help save money next year. For example, did you buy a latte every day before work? The average latte costs about three dollars. That works out to $15 per week for a grand total of $780 a year.

Annualize EverythingAre you spending $10 a day on lunch? If you bring something from home, it will cost perhaps $3. That $7 a day that you save is $35 a week, over $1500 a year.

Create a Birthday BudgetBudget for other people's birthdays every year by saving a small amount out of each paycheck and putting it into a birthday budget.

Only Buy Things That You Need On SaleDon't buy things just because they are on sale! Only buy things you use and then wait until they are on sale, and use coupons!

Shred Financial Papers Before DiscardingInvest in a paper shredder and shred all of your financial papers, receipts, etc. before you throw them away. There is too much identity theft out there and if they are shredded, no one can get your information.

Identity Theft Tip - When Ordering ChecksWhen ordering checks, have only your initials printed in the heading with your address. When signing your checks, use your full name (first and last).

Watch Out When Paying Bills by PhoneOur bank has encouraged it's customers to NEVER pay bills over the phone. They have had many scary stories about things that went wrong for their customers when they did that.

Barter Your Services And SkillsMany of the things I have (or have had) in my adult life I have traded my skills in exchange for. I have cleaned in trade for (to name a few): my sectional couch, Queen size box springs and mattress, bedding, outfits, and many odds and ends.

Staying Prepared for Tax SeasonTax season is here. I've learned the hard way to stay prepared. Throughout the year I save ALL receipts. I use a bookkeeping program and enter the receipts into it weekly or more often as needed.

Credit Card Fraud PreventionRemove any credit cards from your wallet that you do not use on a regular, consistent basis, and store them in a safe location. Or, if this is not an option, check your wallet often to ensure all your credit cards are accounted for.

Identity Theft StoryMy friend had her purse stolen. She had parked her car in an out of the way place in a local state park's parking lot. The park recreational area was situated a long way from the parking lot and by parking it where she did in the large parking lot, there were few cars nearby.

ID Theft, What fun!I have been there and I am still digging out of it. What your not hearing anywhere is the person who took your ID may be as close as a near relative.

Carry ATM Deposit Envelopes In Your CarCarry some extra ATM envelopes in your glove box. If you need to make a deposit via the ATM (checks only, never cash!) you can fill out the envelope before you even get out of your car.

Auto Depositing Your Tax ReturnWhen electronically or e-filing your tax return with an anticipated refund, make sure the bank account you designate for the direct deposit has your name on it.

Review Insurance CoverageRemember to review your insurance coverages regularly. I put this off for a long time, because it confused me. But I made an appointment with our agent, and she was VERY helpful in finding ways to reduce our insurance bills.

Living on One IncomeThe best tip I can give about living on one income would probably be this one. When our daughters were small, we decided that it was important for me to be at home taking care of them every day, especially after we took the cost of child care into consideration.

Keeping Track of Deductions Throughout The YearAt the end of the month when I reconcile my bank statement I go ahead and start adding together all of the tax write offs for January. I staple them all together and put a cover sheet on top with the numbers. I do this at the end of every month.

Save Records For Amended ReturnsKeep all receipts for medical expenses, charity donations, real estate taxes, etc. and file with your tax forms even if you don't itemize that year. You have 3 years to file an amended tax return and it will be much harder to locate the information years later.

By Cheryl from Missouri

Organizing Check Registers By YearEnd your check register with the end of the year and start a new one for the new year. That way you can pack the check registers away with each year's tax paperwork.

By Beverly in TN

Start Working On Your Taxes EarlyIf you think you may be getting a tax refund this year, start working on your taxes now. Use your year-end paycheck stubs for income and taxes withheld; start adding up medical bills; start adding up charitable contributions.

Negotiate CD RatesI found out that on larger amounts of money, CD Rates can be negotiated. They have a margin they can work with. They don't tell you this.

Free Investment Advice at the LibraryInvestment newsletters that give advice on buying and selling securities can cost more than $500 a year, but you can often pick up free investment advice by looking for those same publications in your local library.

Don't Lend The IRS Your MoneyAvoid tax refunds. Getting one usually indicates poor tax planning. It means that you have overpaid your taxes throughout the year. What's worse, you're not even collecting interest on the funds you're "lending" to the IRS.

Long Term Budgeting for BillsWhen you are budgeting for the year ahead, I have one of the simplest and worry free ways to deal with big annual bills like car insurance, property taxes and any other bill that is going to hit your pocketbook once a year.

Add Your Pennies to Your Savings AccountThis will add about $30 every couple months to your savings account:

Start saving all your pennies. After you're used to doing that for a while, start saving ALL your change. Then save all your $1 bills.

I save all my change and (well okay only some) dollar bills and end up with about $30 (give or take)every couple months to put into my savings account.

Where does it come from? I guess it's magic!

By Jayne

Paid off home 8 years early, small payments add up.When we were just buying our first home, we made sure it didn't have any pre-payment penalties, then I ordered an amortization schedule from the mortgage co. I could see that we were paying just a pittance on the principal every month, but lots on the interest. By sending in small amounts every so often, we paid off our loan 8 yrs earlier and saved thousands in interest payments. You can send an extra principal payment every month or 2 & 3 principal payments once every so often. If you just make monthly payments, you will not break even (pay the same on principal & interest) until year 23 on a 30 year loan, so you can see that almost all the money paid out every month is the interest to the mortgage co. This tip is easy to do the first several years when the principal payment is small. Harder to do on the back end of the loan when you pay a lot more of the principal off.

By Linda from OKC

Shave Years off your MortgageIf your mortgage payment is $1200 per month and you normally pay it on the 1st of the month, start paying $600 on the 1st of the month and then on the 15th of the month pay the additional $600.

Find Out Where Your Money is GoingThe first and most important step to setting up a budget is to find out where your money is going now. It is pointless to sit down and write out a budget with imaginary numbers such as 'Groceries - $200' when you are actually spending $400 at the moment.

Save Money and Pay YourselfEstablish a savings account and pay yourself first. Get in the habit of saving money and having money. Make money for you and don't pay interest to someone else.

If the Flynn's Don't Have it . . .There was a large nice family that lived in the neighborhood. My children loved to play with their children. Of course, they lived quite austerely. Whenever my children asked for something they could really live without the rule was: "If the Flynns don't have it you don't need it". Everyone was happy.

By Jules

Markdown BinsFor years I have sought out the markdown bins at grocery and retails stores. Many times I can get an item at half off or more just because the box or can is crushed or one item is missing from a package.

Saving Tip - Save Your Change and Dollar BillsMy husband and I always save our change, but recently we have started saving our one dollar bills. At the end of each day, we put all of our ones in a little bank, and on Saturday, we deposit what we have, this week alone our deposit was $54.00. You'd be amazed how quickly they add up, and you don't really miss them.

By Carol